Unified fulfillment drives growth: Introducing Pando's Fulfillment Cloud

End-to-end orchestration, optimization and visibility of supplier and customer deliveries.

Inbound Fulfillment

Collaborate with suppliers & carriers, local and global, to enable cost-effective transportation with shipment consolidation, optimal routing, real-time visibility on movement of direct materials for production just-in-time minimizing stock-outs or excess inventory & effectively manage demand fluctuations, supply chain disruptions etc.

Outbound Fulfillment

Optimize end to end order fulfillment and drive SKU-level real-time visibility to enhance your customer experience with right mode selection, load consolidation & route optimization, dynamic scheduling for managing disruptions and ensuring optimal stock-levels, real-time collaboration with ecosystem partners building supply chain resilience

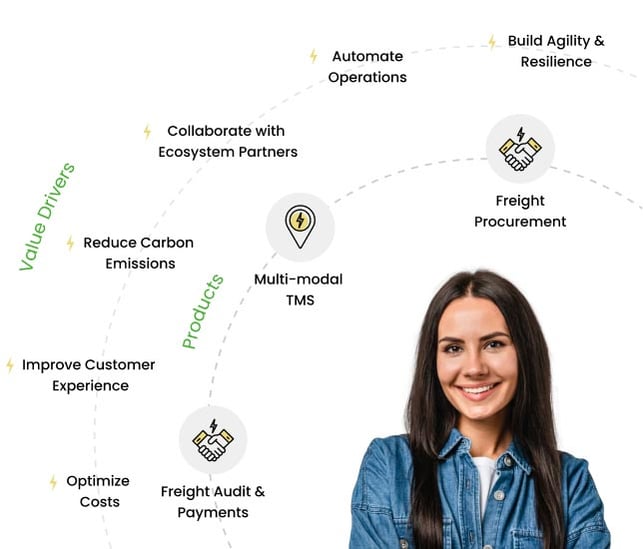

Freight

Procurement

Automate procurement with pre-defined templates, freight benchmarking, carrier discovery, scenario planning & manage dynamic contracts

Multi-modal

TMS

Optimized transportation planning with collaborative execution across modes, legs of movement driving real-time visibility

Freight Audit

& Payment

Unlock 100% freight spend visibility with flexible rate management, digital invoicing, automated reconciliation, accruals & payments

Automate procurement with pre-defined templates, freight benchmarking, carrier discovery, scenario planning & manage dynamic contracts

Optimized transportation planning with collaborative execution across modes, legs of movement driving real-time visibility

Unlock 100% freight spend visibility with flexible rate management, digital invoicing, automated reconciliation, accruals & payments

United teams fulfill dreams

Discover how your team can benefit from a modern, end-to-end unified Fulfillment Cloud.

Pando is loved by...

One touch integrations

Plug and play APIs to integrate seamlessly with enterprise ERPs, carrier systems, IoT devices, and other solutions in your business.

World-class security

Enterprise-grade platform with access rights management, data security, mobility, document management, and a data lake.

Effortless UX

Intuitive, network-first user experience that drives speedy adoption across your supply chain network.

Unified master data

Master data management across all your vendors, carriers, facilities, SKUs, and customers in one place.

Immediate ROI

Reduce freight costs by 12-14% within two quarters post-implementation.

Simplify freight audit & payment

Enable strict control over base and accessorial freight through our unified platform.

Currency & tax control

Unlock automatic currency conversion and global tax compliance for freight.

Better PO accuracy

Modular solutions backed by our powerful unified platform allow for better control for direct materials, inbound and outbound freight.

Simplify order coordination

Say goodbye to coordination between distribution center teams and customers for order visibility. You just need to send a magic link on dispatch!

Recognize revenue faster

Quicker dispatches and faster deliveries means shorter order-to-cash cycles.

Better customer service

Ensure real-time end-to-end visibility and ETA availability for customers.

Reliable deliveries with On-Time In-Full assurance

Improve service level adherence by 21% with streamlined order fulfillment.

Real-time visibility

Benefit from availability of shipment status and ETA from time of order until delivery.

Data-backed resolution across delivery issues

Time-stamp each activity from dispatch to delivery and enable closed loop availability of audit trail for all deliveries.

Real-time communication

Online communication of shipment creation, modifications, and spot RFQs for easy coordination with shipper.

Easy & accurate invoicing

Unlock access to automated rate calculations for each shipment that tie back to contracts.

Faster payments

Reduce payment cycles to less than 15 days from shipment execution.

Streamlined business

Digitization of all transactions removing human errors and inefficiencies.

Increased inclusivity into shipper's business

Enhance supplier collaboration from PO creation until delivery realization.

Simplify dispatch process

Provide real-time visibility to suppliers with regard to pickup schedules, carrier information, and driver details for coordinated handover.

Easy resolution across supply issues

Time-stamp each activity from pick up to delivery at shipper's location with a reliable audit trail.

IT

One touch integrations

Plug and play APIs to integrate seamlessly with enterprise ERPs, carrier systems, IoT devices, and other solutions in your business.

World-class security

Enterprise-grade platform with access rights management, data security, mobility, document management, and a data lake.

Effortless UX

Intuitive, network-first user experience that drives speedy adoption across your supply chain network.

Unified master data

Master data management across all your vendors, carriers, facilities, SKUs, and customers in one place.

Finance

Immediate ROI

Reduce freight costs by 12-14% within two quarters post-implementation.

Simplify freight audit & payment

Enable strict control over base and accessorial freight through our unified platform.

Currency & tax control

Unlock automatic currency conversion and global tax compliance for freight.

Better PO accuracy

Modular solutions backed by our powerful unified platform allow for better control for direct materials, inbound and outbound freight.

Sales

Simplify order coordination

Say goodbye to coordination between distribution center teams and customers for order visibility. You just need to send a magic link on dispatch!

Recognize revenue faster

Quicker dispatches and faster deliveries means shorter order-to-cash cycles.

Better customer service

Ensure real-time end-to-end visibility and ETA availability for customers.

Customers

Reliable deliveries with On-Time In-Full assurance

Improve service level adherence by 21% with streamlined order fulfillment.

Real-time visibility

Benefit from availability of shipment status and ETA from time of order until delivery.

Data-backed resolution across delivery issues

Time-stamp each activity from dispatch to delivery and enable closed loop availability of audit trail for all deliveries.

Carriers

Real-time communication

Online communication of shipment creation, modifications, and spot RFQs for easy coordination with shipper.

Easy & accurate invoicing

Unlock access to automated rate calculations for each shipment that tie back to contracts.

Faster payments

Reduce payment cycles to less than 15 days from shipment execution.

Streamlined business

Digitization of all transactions removing human errors and inefficiencies.

Suppliers

Increased inclusivity into shipper's business

Enhance supplier collaboration from PO creation until delivery realization.

Simplify dispatch process

Provide real-time visibility to suppliers with regard to pickup schedules, carrier information, and driver details for coordinated handover.

Easy resolution across supply issues

Time-stamp each activity from pick up to delivery at shipper's location with a reliable audit trail.

Your unique needs: Fulfilled

Explore how Pando's unified Fulfillment Cloud can help drive business impact for your industry.

Agile supply chains are powered by Pando

Trusted by Fortune 500 enterprises worldwide

Congratulations to Pando for making their debut in the Gartner TMS Magic Quadrant! Our partnership with Pando has accelerated our visibility on ocean freight and improved rate management. Pando has helped us realize significant cost savings, deliver superior customer experience, and collaborate with our ecosystem partners seamlessly to build an agile supply chain. Pando gives us a competitive advantage in the marketplace!

Skotti Fietsam, SVP of Global Supply Chain

Glad to witness Pando's recognition by Gartner! Through their integration of advanced AI technology, logistics expertise, and top-tier talent, Pando has become a key partner for us. Their solutions streamline our freight procurement to payment processes, driving meaningful changes in our supply chain toward greater agility and sustainability. Congratulations to the Pando team for their well-deserved recognition!

Mayank Pandey, Wholetime Director of Supply Chain

Congratulations to Pando on the well-deserved Gartner recognition! We needed a unified platform to collaborate with our vendors seamlessly, derive intelligence from our network, plug into our evolving IT landscape, scale with our business, and provide rapid value realization and Pando checked all our boxes. We're proud to be a Pando customer!

Neha Parekh, Director of Supply Chain

Pando's platform provides the end-to-end freight spend visibility, real-time analytics, predictive intelligence and collaborative automation through its AI tools, to optimize our logistics operations. These AI tools complement our supply chain team, so they are able to do more and have a greater impact than before!

Christopher Held, Chief Supply Chain Officer